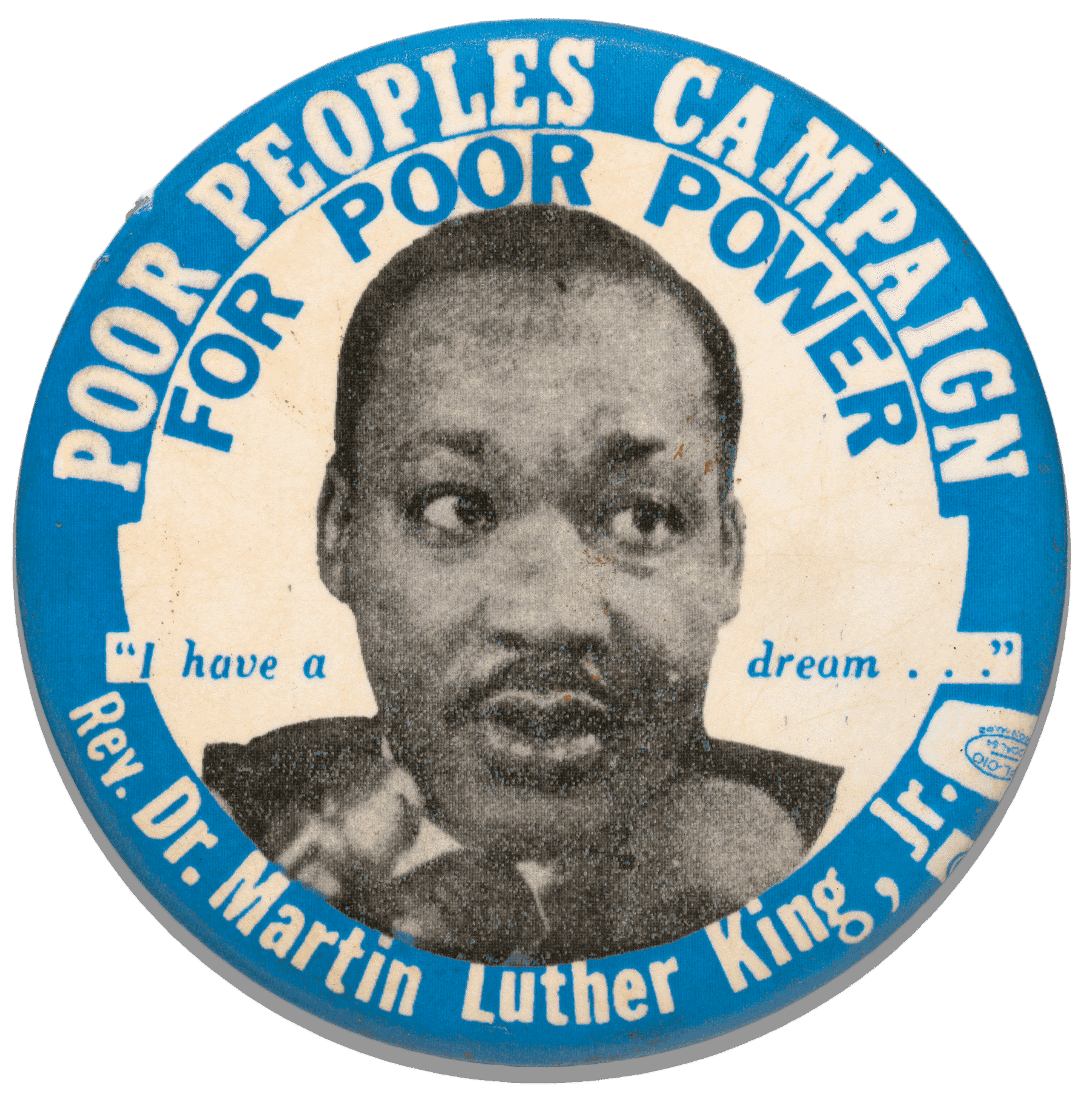

Freedman’s Savings Bank

Chartered by Congress in 1865, the Freedman’s Savings Bank was intended to help formerly enslaved African Americans build wealth and economic security. But the bank’s collapse in 1874 cost thousands of depositors their savings. The Freedman’s Savings Bank reflected the promises and failures of Reconstruction and the struggle to secure full freedom and equality for African Americans.

Freedman’s Savings Bank

Freedman’s Savings Bank deposit book

In March 1865, Congress incorporated the Freedman’s Savings and Trust Company, known as the Freedman’s Savings Bank. The bank, run by white trustees, promised newly freed African Americans, including Civil War veterans, a safe place to deposit their money. But after Congress relaxed its restrictions on the bank's policies, corrupt officials used the savings funds for risky investments and bad loans. This made the bank vulnerable to the financial panic that swept the nation in 1873, and in 1874, the bank collapsed.

Over 60,000 depositors lost nearly $3 million in savings. Many spent decades petitioning the government for reimbursement. Ultimately, only about half of the money was repaid. The failure of the Freedman’s Savings Bank had a devastating financial impact on African American families and communities. It also foreshadowed the discrimination and difficulties African Americans would face as they tried to establish economic security and build wealth through the generations.

Bank Books

Depositors recorded their funds in these company-issued bank books.

Despite my efforts to uphold the Freedman’s Savings and Trust Company it has fallen. It has been the Black man’s cow, but the white man’s milk.

Frederick Douglass, 1874

Bank Closure

Freedman’s Savings Bank letter signed by Frederick Douglass

By March 1874, the Freedman’s Savings Bank was in financial crisis. In an effort to reassure African American depositors, officials elected Frederick Douglass as bank president. Douglass had been a prominent supporter of the bank, serving as a trustee and also holding a personal account. When confronted with the bank’s financial troubles, he agreed to loan $10,000 of his own funds to the institution as an emergency aid measure. But Douglass soon realized the bank was insolvent and beyond saving, and he advised Congress to shut it down to prevent further losses. He wrote this letter to one of the commissioners appointed to take charge of the bank’s assets.

Douglass regretted his association with the Freedman’s Savings Bank, stating that it was a “connection which has brought upon my head an amount of abuse and detraction greater than any encountered in any other part of my life.”

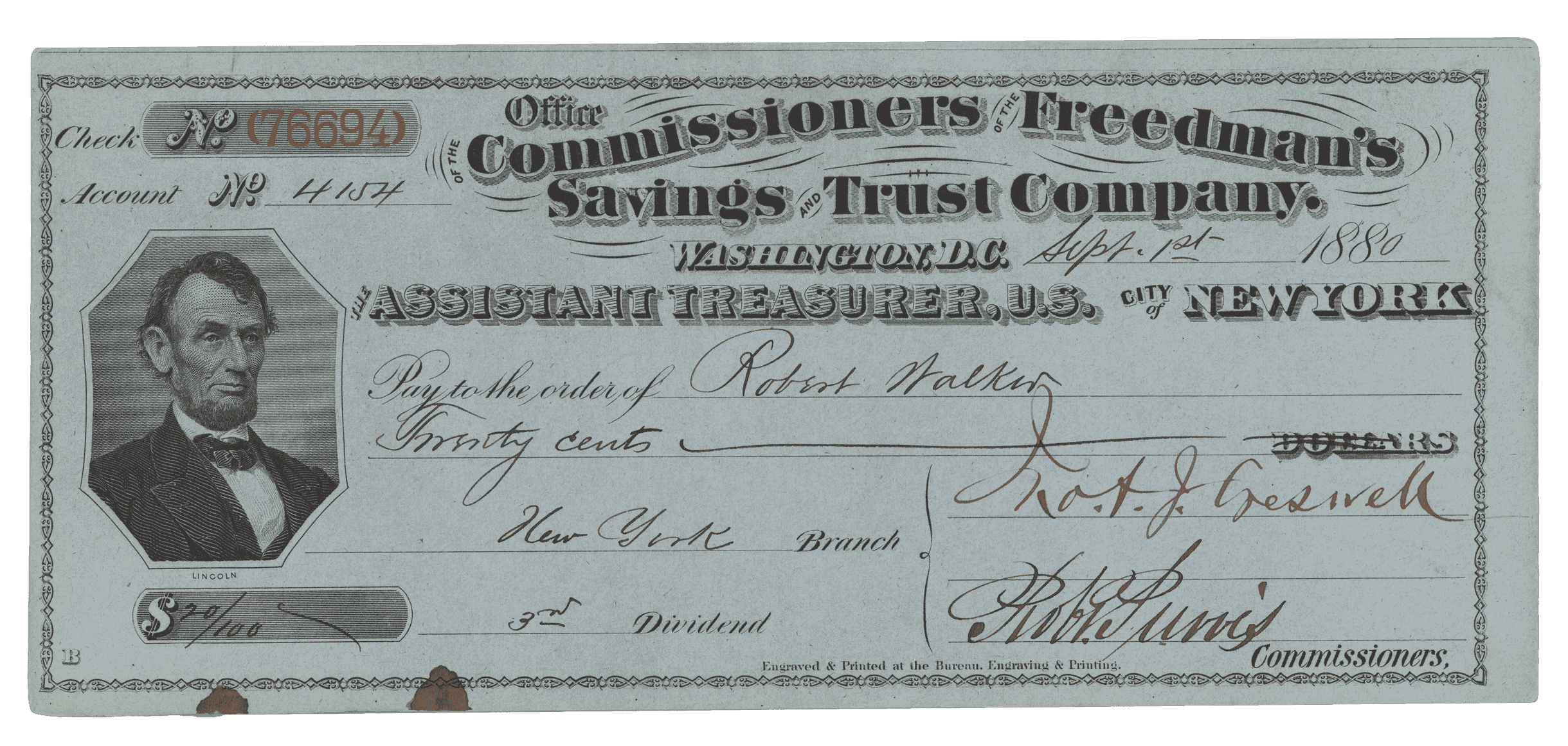

Paying Dividends

For several years after the bank closed, from 1875 to 1883, commissioners issued dividends to account holders for a percentage of their deposits. To claim their dividends, individuals had to submit their bank books to be examined and, if not the original account holders, prove they were the legal heirs. Due to bank books and records being lost, people moving or passing away, and time limits on filing claims, only half of the depositors received any dividend payments. Only a third received all their dividends.

I think the remaining 38 per cent of such of these deposits as have claimants should be paid by the Government, upon principles of equity and fairness.

President Grover Cleveland, 1886

Robert Walker received this dividend check for 10 percent of his $2 deposit in 1880.

Freedman’s Savings Bank Dividend Check

Thousands of African Americans lost their financial foothold when the Freedman’s Savings Bank collapsed. The loss resonates with past and present struggles for economic justice and Black self-determination.

“Pay Us Our Balance”

Petition to Congress from Freedman’s Savings Bank depositors, 1880

Letter from Henry L. Thomas to Walter White, 1939

For decades, account holders and their advocates appealed to the government for full repayment of the Freedman’s Savings Bank deposits. Between 1882 and 1920, there were numerous bills introduced in Congress proposing to appropriate federal funds to reimburse depositors, and several U.S. presidents expressed support for such legislation. But these attempts were consistently blocked and defeated by white southerners in Congress.

In 1927, the U.S. Treasury announced that the remaining assets from the bank’s 1874 liquidation were depleted, and no further funds were available. But depositors and their descendants continued to press their claims. In 1939, Henry L. Thomas wrote to NAACP Executive Secretary Walter White asking him to lobby Congress for the remaining 38% of the bank’s deposits. “I tried to get my senator to introduce a bill,” Thomas wrote. “The Treasury says no money available. Make it available.”

Impact of the Freedman’s Savings Bank

Freedman’s Savings and Trust Company building in Washington, D.C.

The Freedman’s Saving Bank offered a chance for African Americans to build wealth as they entered a new future in freedom. This wealth provided opportunities to secure land, create communities, secure materials to build their lives, and establish financial foundations for the future. When the bank collapsed, thousands of African Americans lost their savings, much of which was never repaid. The demise of the bank left many in the African American community with a distrust of the banking system.

Recent efforts to reclaim the history of the Freedman’s Saving Bank have uncovered a rich trove of documents containing genealogical information and spurred a renewed interest in increasing financial access for African Americans. The original location of the Freedman’s Saving Bank headquarters in Washington, D.C., where an annex to the U.S. Treasury building now stands, was renamed the Freedman’s Bank Building in 2016 to recognize this significant piece of Reconstruction history.